Table of Contents

With thousands of fintech startups competing for market share, it’s no easy task for fintech brands to stand out from the crowd and attract new customers. Throwing money at the problem is no longer a sustainable solution as customers become more sophisticated and commercially aware of competing brands.

In this article, we’ve gathered a list of the top 7 challenges financial institutions face when implementing digital marketing strategies for their brands. We also provide ways to overcome these challenges from a long-term perspective, with the overall goal of lowering the cost of acquisition of each customer.

Challenge #1: Building a brand in a crowded environment

The fintech industry in Southeast Asia is highly competitive and has experienced significant growth over the past 15 years. According to recent research by Mordor Intelligence, the Asia-Pacific (APAC) fintech market is projected to witness the fastest growth at a CAGR of around 16% during the forecast period of 2023-2028.

For a brand, one of the main challenges is to stand out in a crowded market. Maintaining top-of-mind awareness is crucial, and having a strong brand is essential to achieving this. A robust and impactful brand can directly influence the number of customers a business can acquire and the cost at which it does so.

Our work with SoCash is an excellent example of how fintech companies can build trust with their customers to grow at an accelerated rate.

Challenge #2: Acquiring customers effectively

Acquiring customers in the financial technology industry can be challenging due to various regulatory requirements, privacy regulations, and anti-money laundering laws. Optimising the end-to-end process of acquiring customers through a digital environment has been a significant challenge for fintech companies in recent years.

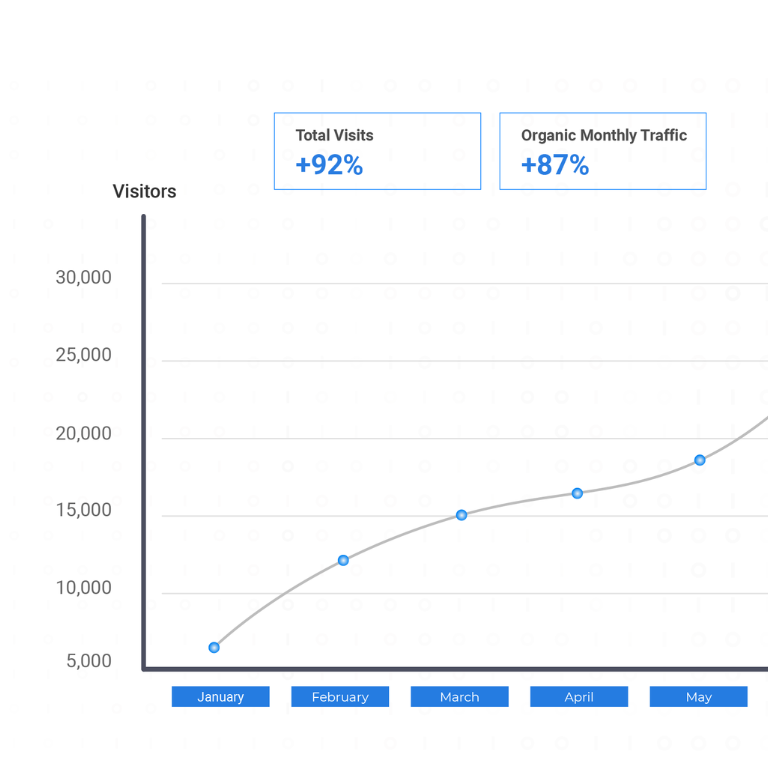

To tackle this challenge, MoneySmart collaborated with us to develop a new, optimised performance marketing strategy to drive more efficient customer acquisition over time and demonstrate value to their customers.

Optimizing the eKYC (electronic know your customer) process is crucial for fintech brands to succeed. A well-designed eKYC process can lead to an increase in the number of new customers and a reduction in the cost per acquired customer. One of the latest developments in eKYC technology is the use of a physical person to verify a customer’s identity. The verification can be done during the sign-up process through a video call.

Challenge #3: Acquiring customers efficiently

Acquiring customers is one thing but doing so efficiently is a different challenge. Optimizing the eKYC process can be beneficial, but other factors also play a role in customer acquisition.

Fintech brands should focus on providing a great user experience on their website and mobile app. This includes simplifying the user journey and ensuring that platforms and technology are stable and dependable. All these factors have a direct impact on conversion rates, which in turn, can reduce the cost of customer acquisition (CAC), improving the overall unit economics of the business.

Check out the latest cutting-edge eKYC solutions provided by Jumio, KMS Solutions, and ShuftiPro.

Challenge #4: Using correct ROI models to measure impact

Linking the cost of acquiring a customer to their actual lifetime value (LTV) can be a challenge for companies in the fintech industry, due to the complexity of financial services.

For instance, calculating the LTV of customers who take out loans with varying interest rates can be difficult, as well as considering discounts or welcome gifts. Additionally, linking and cross-selling activities to a customer’s profile and measuring the revenue impact of referral programs can be challenging. While it is possible to do all these things, it can become complex in practice.

Challenge #5: Creating a single view of the customer

Fintech companies often struggle to create infrastructure that allows them to create a single view of a customer (SCV). Creating an SCV is about connecting different data points from various data sources to a single customer ID. Simple customer data platform (CDP) solutions such as Segment or Tealium could be a great starting point for fintech companies to achieve this.

Challenge #6: Paid marketing efforts fail to deliver satisfactory results

Efficient digital marketing is key for fintech brands to be successful. Supported by a strong brand, digital marketing is often the key driver of growth in the fintech space. Having worked with multiple players in the space over the last year, we see the below challenges coming back often:

- Difficulty in understanding the target audience.

- Not having a clear and detailed value proposition in place.

- Lack of a data and user journey strategy.

- Ineffective management of pay-per-click (PPC) advertising.

- Allocating too much budget to performance marketing.

- Not focusing on the right marketing metrics.

- Limited investment in marketing automation tools.

- Lack of a strategy for upselling or cross-selling products or services.

- Too much emphasis on using giveaways and incentives at the top of the funnel to drive conversion rates.

Challenge #7: Be a real alternative for traditional financial services

While the fintech industry is competitive, it is important to remember that fintech brands are also competing with traditional financial service providers, some of which are among the largest companies in the world. To be successful in this competition, fintech companies must ensure they are a viable alternative to the status quo. To achieve this, they should focus on:

- Transparent and competitive pricing for all products and services.

- Offering innovative and unique products or services.

- Providing a superior user experience compared to traditional players.

- Developing a high level of trust with customers.

- Building close relationships with customers.

- Efficient use of technology to enhance operations and customer experience.

Moving beyond performance marketing: Building authentic relationships with customers

As consumers become savvier and the digital landscape evolves, performance marketing is no longer the be-all and end-all of digital marketing. Performance marketing, which focuses on driving sales and conversions through tactics such as pay-per-click (PPC) advertising, is becoming less effective as consumers become more resistant to traditional advertising methods. Brands that want to stay ahead of the curve need to move away from performance marketing and focus on building relationships with their customers.

With the rise of ad-blockers and the growing mistrust of online advertising, it is becoming increasingly difficult for brands to reach their target audience through traditional performance marketing methods. Consumers are becoming more selective about the brands and products they engage with and are looking for a more authentic and personalised experience.

Another reason that brands should move away from performance marketing is that it is becoming increasingly expensive. As the digital landscape becomes more crowded, the cost of reaching a target audience through performance marketing methods is rising. This is making it increasingly difficult for brands to justify the cost of performance marketing campaigns and is driving many to look for more cost-effective alternatives.

So, what should brands do instead of performance marketing? The answer is building relationships with their customers. This can be done through a variety of methods such as content marketing, social media marketing, and influencer marketing.

These methods allow brands to build trust and credibility with their customers by providing them with valuable and engaging content. They also allow brands to interact with their customers on a more personal level and to create a more authentic and personalised experience.

Final Thoughts

In conclusion, as consumers become more resistant to traditional advertising methods and the cost of performance marketing rises, brands need to move away from performance marketing and focus on building relationships with their customers. This can be done through a variety of methods such as content marketing, social media marketing, and influencer marketing.

By building relationships with their customers, brands can create a more authentic and personalised experience that will help them to stay ahead of the curve in the digital landscape.

Are you facing these digital marketing challenges? Drop us a note at hello@admiral.digital and we’ll be happy to advise you on overcoming them.